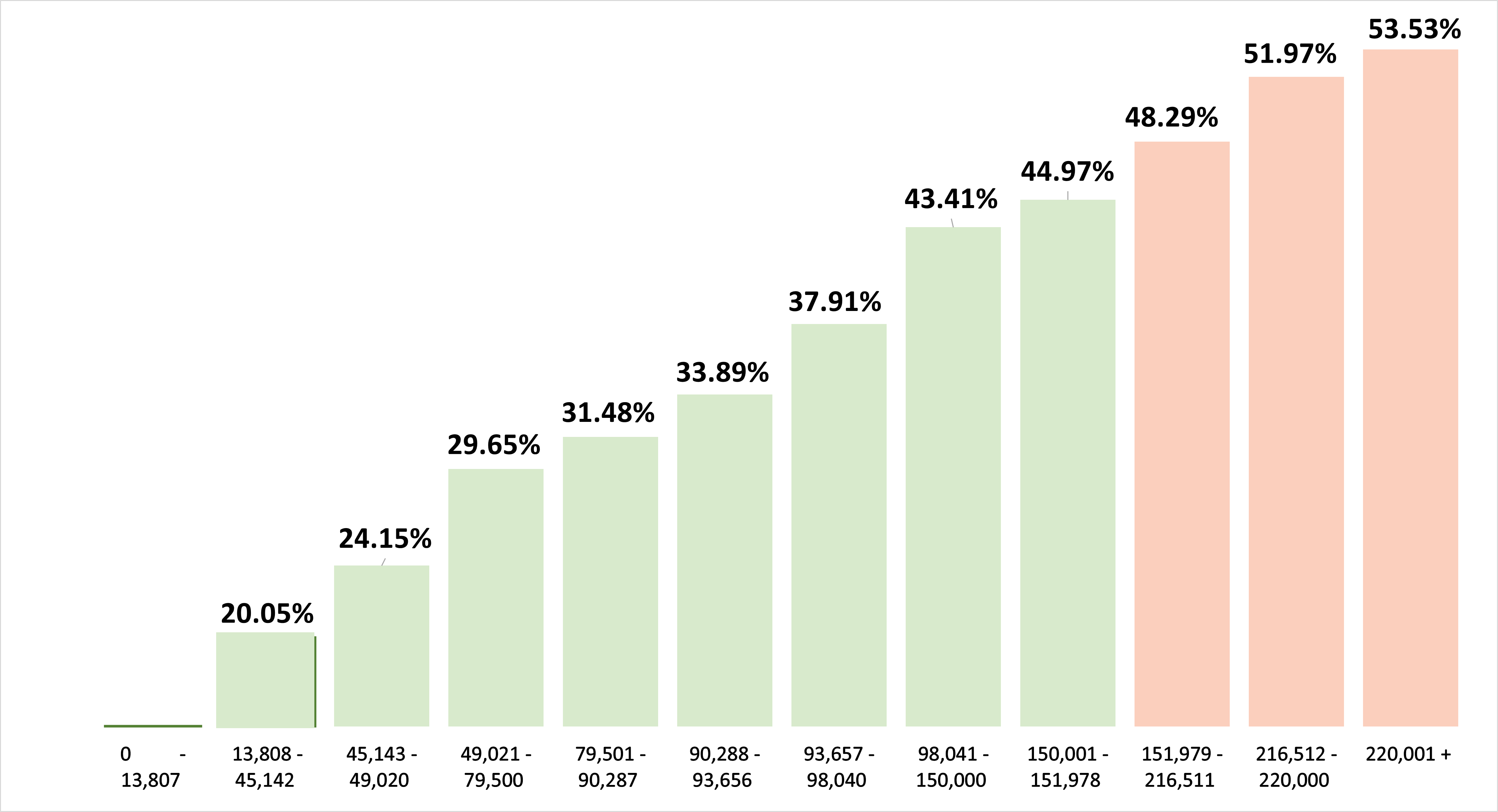

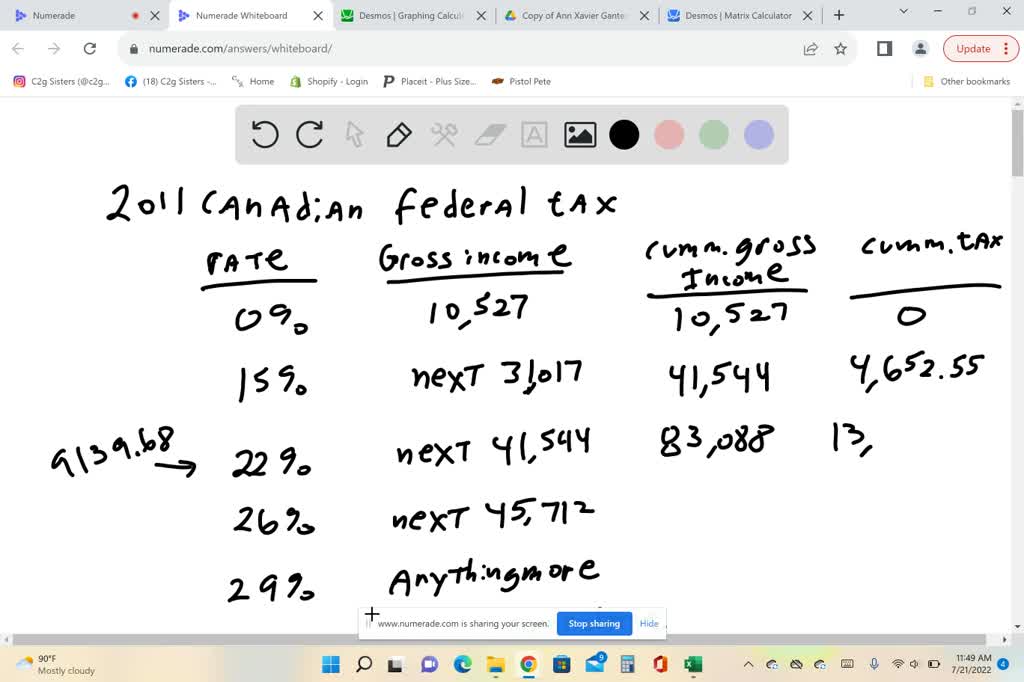

SOLVED: In 2011, Canadian federal tax rates were 0% on the first $10,527 of gross income earned, 15% on the next $31,017, 22% on the next $41,544, 26% on the next $45,712,

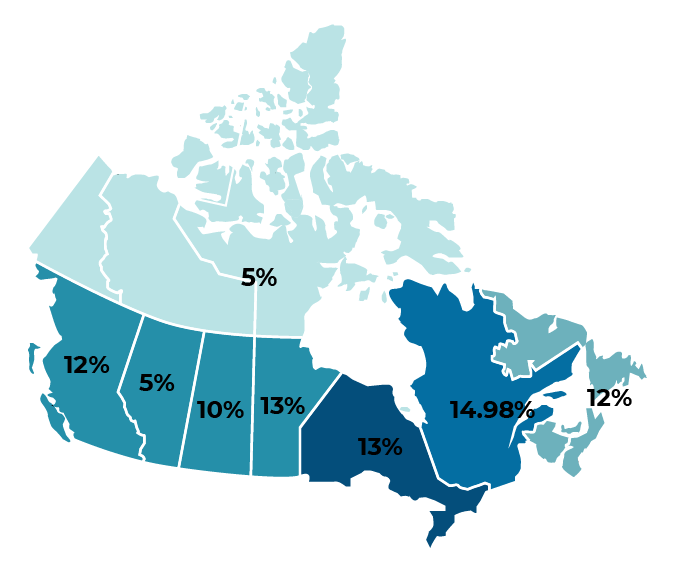

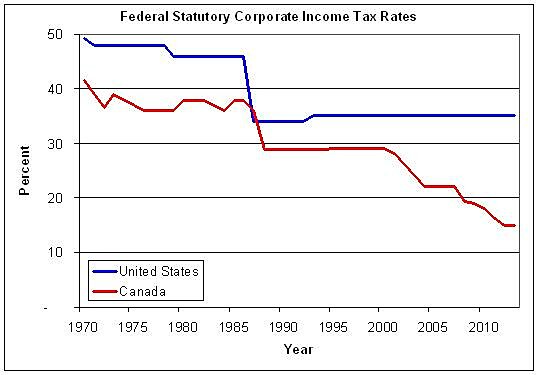

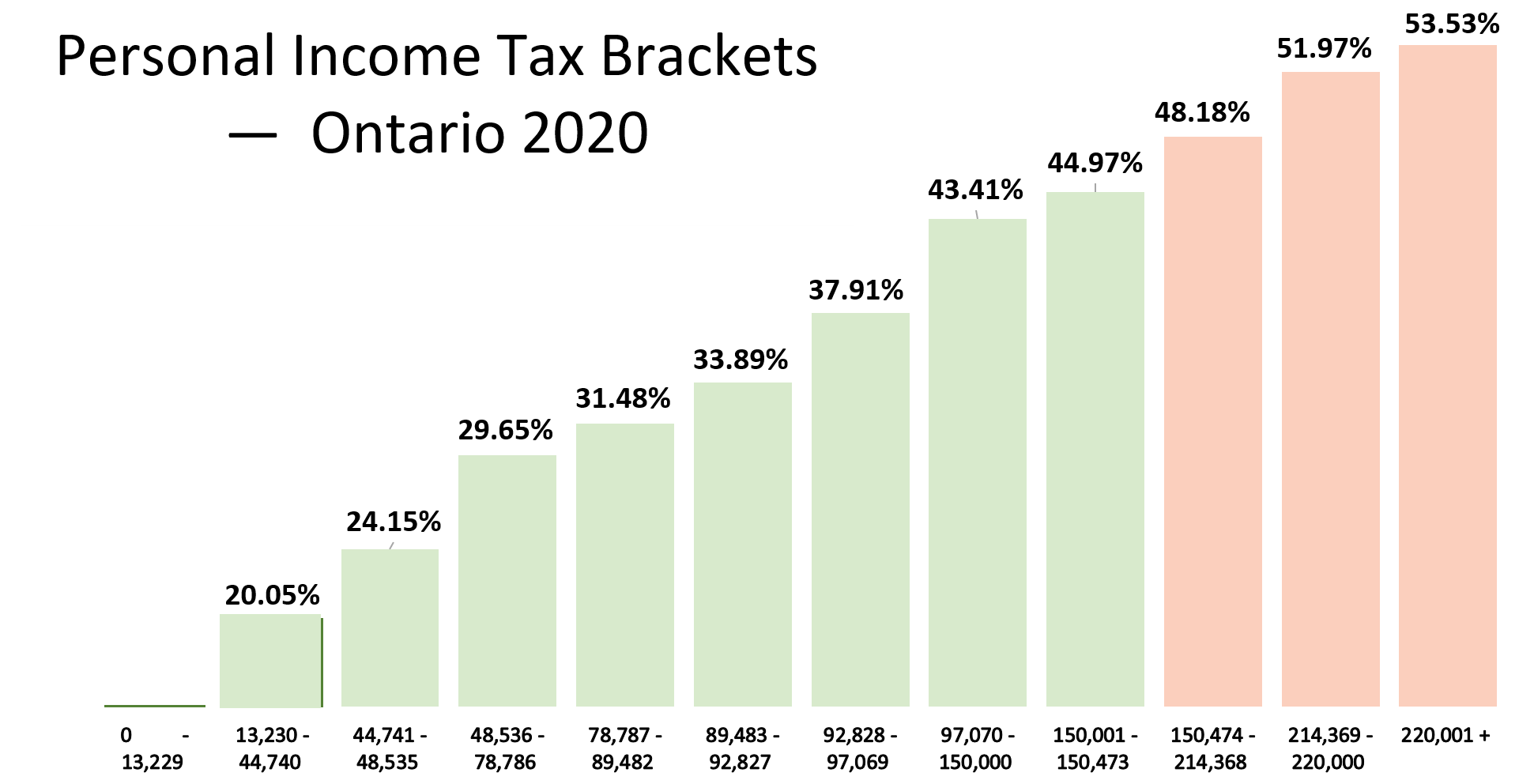

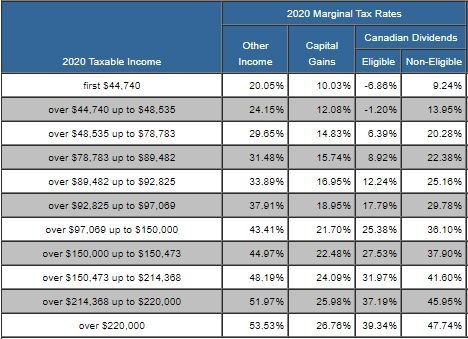

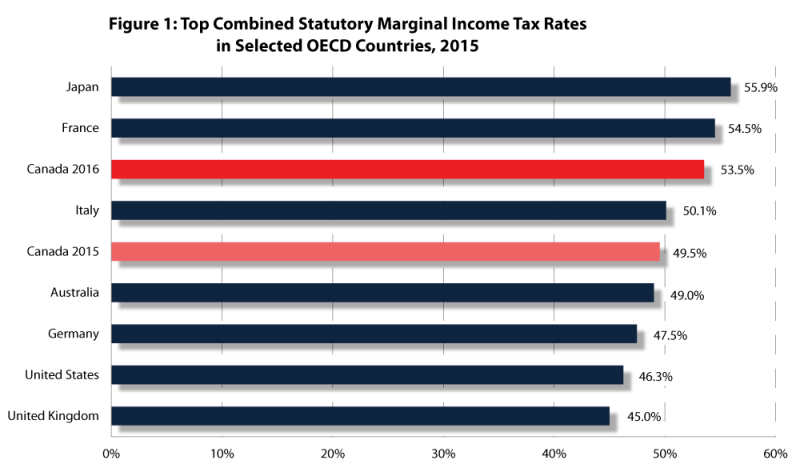

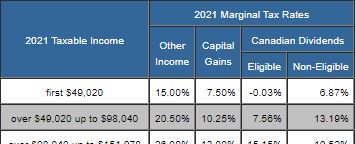

Canada's personal income taxes on highly skilled workers now among the highest in industrialized world | The Nelson Daily

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)